Introduction to AutoPay

AutoPay simplifies the process of keeping your account in credit and your service rental paid up to date, so you don't need to worry about your numbers being disconnected, or running out of calling credit.

There are 2 main concepts:

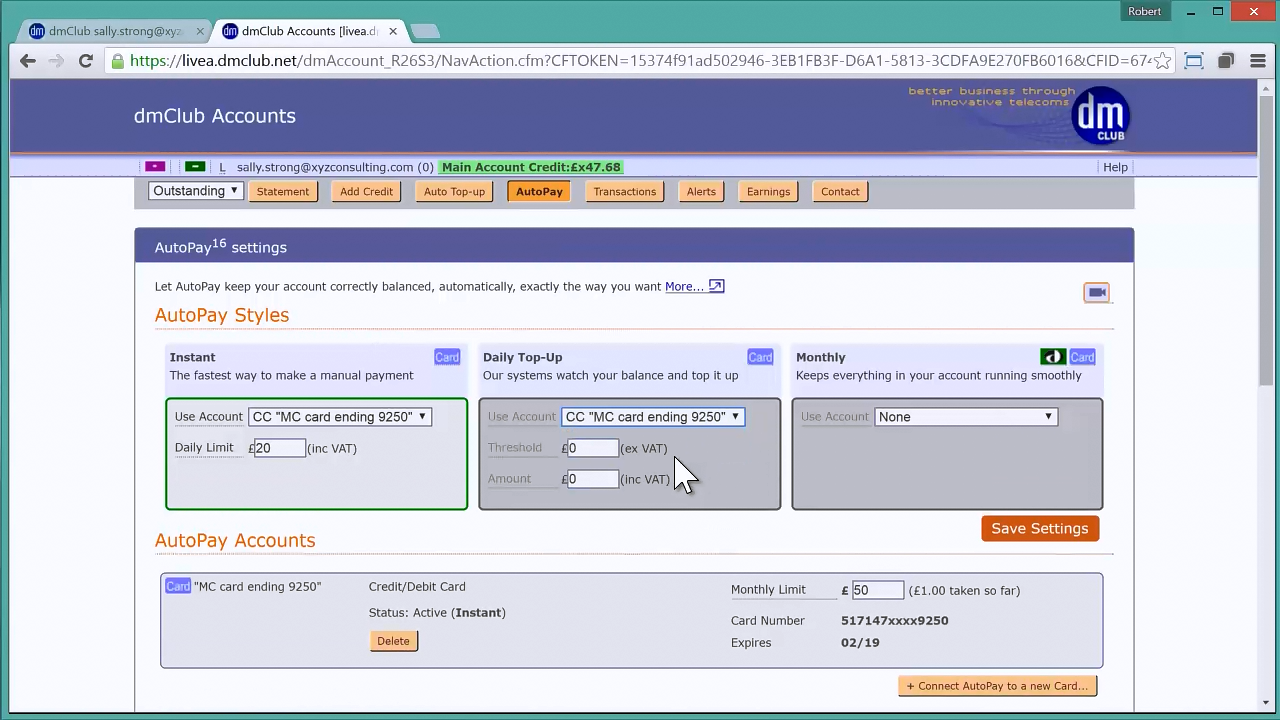

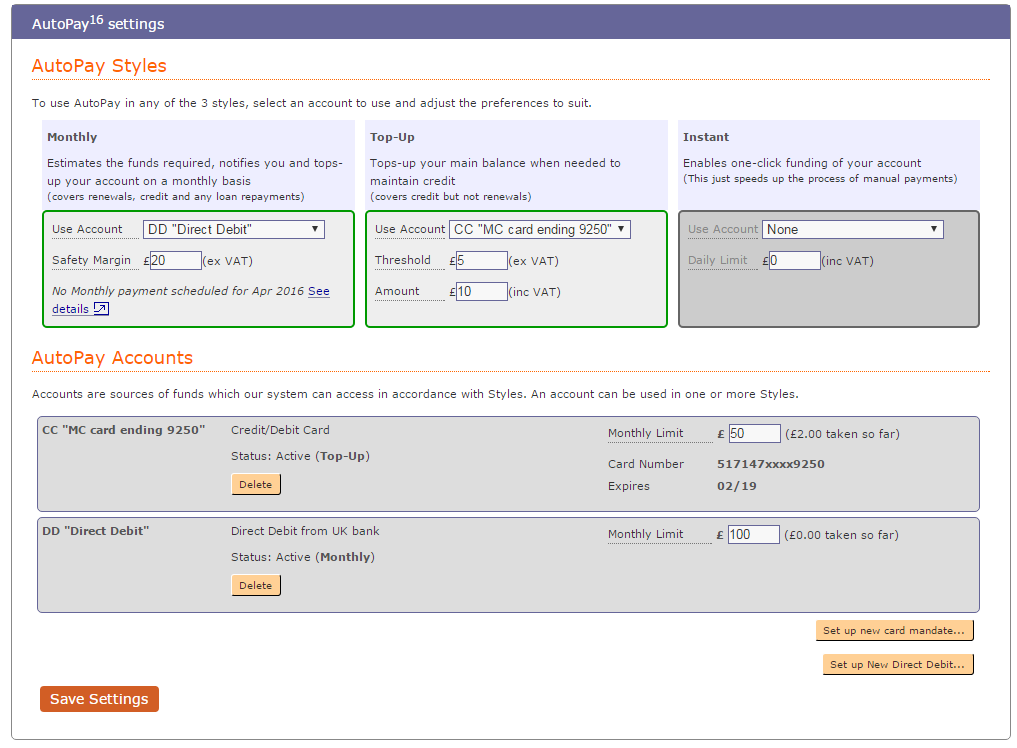

Styles - These specify the ways in which you would like the system to take money using the AutoPay Accounts. You can have several styles, all set up within the AutoPay screen.

- Instant - You can enable almost-one-click payments into your account from the new card

- DailyTop-Up - where you specify a threshold and an amount of money to take when your main balance drops below that level.

Note that (as of July 2017) Daily Top-Up can also try to maintain a healthy balance to pay off outstanding renewal orders and loans with the "Full protect" option. - Monthly - where the system estimates how much money your account needs* and bills once a month

(* to pay for renewals, estimated usage, repay any temporary loans and keep account in credit by the safety margin)

Accounts - These are sources of funds, eg. Credit/Debit cards or a Direct Debit arrangement with your bank. You can set up one or more accounts from the AutoPay screen. You are also setting up an account if you ask the system to remember credit card details.

NB: To get AutoPay working you will need at least one style and one account to be setup!

Recommendations

We recommend that you go for AutoPay monthly, which tries to take just enough money each month to keep your accounts running and sends you an itemised statement beforehand. For low volume users with few numbers, it could be that money is taken just once every few months, whereas busy accounts may require regular monthly amounts.

We recommend that you also have AutoPay Top-Up just in case there is a surge in usage (or if you suddenly start using a high-value service like dmAnswers14). If your settings for AutoPay monthly are well-tuned, one would hope that Top-up isn't required, but it's good to know it's there. Note that AutoPay Top-Up requires a Card Account (Direct Debit is too slow).

For example:

Monthly by Direct Debit with Safety Margin of £20 (the system will take enough each month to maintain a main balance of £20 over your first alert level assuming usage is stable)

Top-Up by Credit Card with Threshold of £5 and amount of £10 (so if the main balance drops below £5, it should take £10)

The Accounts might have monthly limits of £100 (direct debit) and £50 (credit card)

AutoPay FAQ

Q: When does Daily Top-up check my account balance?

A: 10 minutes after every hour (eg. 00:10, 01:10, 02:10....23:10)

see also:

#0100 Accounts: Credit, Orders and Payments & FAQ for more general information on Payments

If you have any questions relating to AutoPay that are not answered here or on one of the "see also" pages then contact support with your question, with subject line "AutoPay FAQ"

Q: If Daily Top-Up Full Protect pays off a loan or an order, might that leave my main balance a bit low?

A: No - it will never use your available balance to pay off loans/orders if that would mean your account level dropping below the first alert level (set in the Alerts tab)

Q: How does Daily Top-Up Full Protect decide which loans and renewal orders it will pay off first?

A: It will do loans first (biggest loans first within this) and then Orders (oldest orders first).

Q: If I have AutoPay, can I ignore the warning emails?

A: No! The system will not send you nearly so many emails, but if AutoPay was unable to take money for any reason (eg. low limits, failed bank, administrative error) this can still cause trouble. If you get a warning, don't ignore it - report it to support if you think it's an administrative error before yout number is disconnected.

Q: How does AutoPay monthly decide how much to take?

A: It is a combination of unpaid renewal orders, outstanding loans, your current balance, expected usage (this is taken as the highest level of usage in the last 6 months with a 50% safety margin), your low credit warning level and the safety margin.

If you click on the "Estimate" link, it will display the current state of calculations.

Q: How can I change my bank details for Direct Debit?

A: Call GoCardless support on 020 7183 8674 who can help.

I am not sure what Daily AutoPay settings to start with...

We generally suggest that you start with

- a Threshold of £4

- an amount of £10

In general if the system thinks that you need more money it will tell you.

Don't forget to have your Membership contact details up to date including the SMS option